Page 331 - 2019 6th AFIS & ASMMA

P. 331

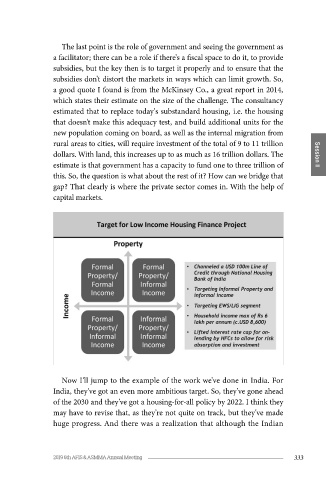

of this and growing these markets, particularly in lots of countries where The last point is the role of government and seeing the government as

we're working, where you're starting from the ground up, you're looking a facilitator; there can be a role if there's a fiscal space to do it, to provide

at simplest solutions, like liquidity facilities, to really provide that first subsidies, but the key then is to target it properly and to ensure that the

bridge between housing assets and investors looking for a match to their subsidies don't distort the markets in ways which can limit growth. So,

liabilities. a good quote I found is from the McKinsey Co., a great report in 2014,

which states their estimate on the size of the challenge. The consultancy

I think the kind of model that we've certainly followed is the model in estimated that to replace today's substandard housing, i.e. the housing

Malaysia that we're now seeing replicated in many countries. Whether that doesn't make this adequacy test, and build additional units for the

it's Pakistan, Nigeria, Kenya, where we're setting up all of these new new population coming on board, as well as the internal migration from

institutions. And capital markets are also looking at links to provide rural areas to cities, will require investment of the total of 9 to 11 trillion

financing for developers, financing for rental housing investment. The dollars. With land, this increases up to as much as 16 trillion dollars. The Session II

key there is just to have an efficient market, data-driven market, where estimate is that government has a capacity to fund one to three trillion of

risk can be priced adequately and to create an efficient mechanism for this. So, the question is what about the rest of it? How can we bridge that

institutional investors to get exposure essentially to the housing sector. gap? That clearly is where the private sector comes in. With the help of

And some of that can be done through the fourth category, which is capital markets.

having innovative risk sharing mechanisms, whether it's looking at how

you can provide credit to those working in the informal sector, without

facing all of the risks, and taking on board the lessons learnt from the

global financial crisis and the subprime crisis in particular. We shouldn't

necessarily equate those working in the informal sector with high credit

risk. Our experience particularly in India is that default levels are lower

as long as your underwriting is done in the right way.

Now I'll jump to the example of the work we've done in India. For

India, they've got an even more ambitious target. So, they've gone ahead

of the 2030 and they've got a housing-for-all policy by 2022. I think they

may have to revise that, as they're not quite on track, but they've made

huge progress. And there was a realization that although the Indian

332 2019 6th AFIS & ASMMA Annual Meeting 333