Page 359 - 2019 6th AFIS & ASMMA

P. 359

economists looking into question of whether every American is An alternative to the reverse mortgage is probably selling the house

financially prepared for retirement. And they have very different answers. and move to a new, smaller house; this involves transaction costs and

It turns out they were using different assumptions. it also means you are going to spend the retirement in a different place,

which as the research shows, is not very helpful for your mental health at

The main assumption they were using in difference was actually retirement.

whether the housing is going to be counted as liquid or not. If housing

is counted as liquid, then most of us households are financially ready for The disadvantage here is that, especially in terms from the lenders

the retirement. If that is not the case, then every household in the US is point of view, the maturity is uncertain. So we don't really have any fixed

not actually ready for their upcoming retirement. date for the maturity; the maturity date is the date that the borrower

passes away. The second problem is the Agency Problems. So one part of

the problem is adverse selection, because it is very likely that the retirees

with a private information of their own longevity borrow through these

mortgage products. Another part of the Agency Problem is moral hazard;

as a retiree, you understand that you house is not the individual's or your

heir's, so you have much less incentive to maintain the house properly. Session III

So the value of the house at the end is probably going to lower than what

the lender expected at the time of the lending.

So that really tells us how important the liquidity of housing equities

is for average American households' retirement. Reverse mortgage is

one solution to make the housing liquid. The idea is pretty simple;

homeowners are going to borrow, using the house as collateral, but unlike

regular closed and installment loans, in the reverse mortgage, contractors

know the installment payment requirement. Only the collateral, the

house, really matters. So the household can enjoy withdrawing from

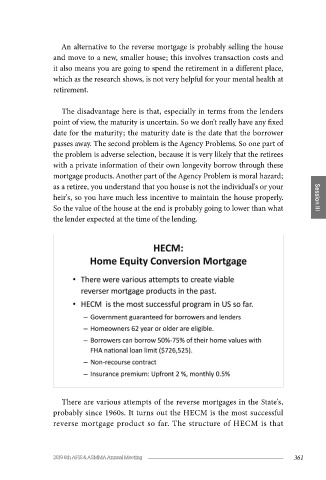

the equities, but they actually don't have any payment requirement until There are various attempts of the reverse mortgages in the State's,

either they die or move out of the house. So the advantage of this reverse probably since 1960s. It turns out the HECM is the most successful

mortgages is low transaction costs. reverse mortgage product so far. The structure of HECM is that

360 2019 6th AFIS & ASMMA Annual Meeting 361