Page 364 - 2019 6th AFIS & ASMMA

P. 364

Let me give you some examples quickly. Let's say there are three

people. The first one is Mr. Kim, the second borrower Mr. Lee and the

third Mr. Park. Mr. Kim draws in month 1, month 2, month 3; he didn't

make a draw in month 4 but he draws in month 5 and 6. And he pays

off. Mr. Lee on the other hand is going to draw every month. Mr. Park

also draws every month but he prepaid much earlier, so in the month

5 is going to pay off his whole loan. In this case, what happens is that

the HMBS is going to be structured based on the first row of each three

loans. So the first three draws of Mr. Kim's, Mr. Lee's and Mr. Park's is

going to constitute one mortgage-backed securities. Next month, another

mortgage-backed securities will be structured based on their second

draws and so on.

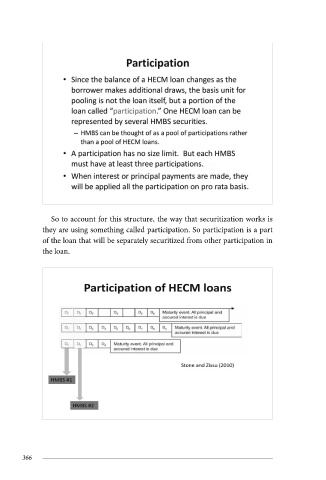

So to account for this structure, the way that securitization works is Session III

they are using something called participation. So participation is a part

of the loan that will be separately securitized from other participation in

the loan.

What happens here is that any individual mortgage loan is going to be

represented by several mortgage-backed securities. So in a sense, HMBS

is not really pooling the reverse mortgage loans, they are actually pooling

the participation of each individual mortgage loans.

366 2019 6th AFIS & ASMMA Annual Meeting 367