Page 388 - 2019 6th AFIS & ASMMA

P. 388

» Panelist | Tyler T. Yang

Yes, I think for pricing purpose, breakeven should be the right

concept. But, it was great point to raise the question. Given the payoff is

the asymmetric to the house price appreciation, they're just taking the

expected house price to draw your breakeven rate, which can be biased.

Since we took over the HECM actuarial review, we actually use the

Monte Carlo simulation to find out the break-even point, by calculating

expected losses as per different potential house price appreciation rate.

» Moderator | Richard K. Green

But even so, there still may be a tail of losses in the extreme cap. So

at what extent do you want to limit that extreme tail, or do you want to

limit it? Session III

» Panelist | Tyler T. Yang

Yeah, if we are dealing this with a private market, to get a Triple A

rating, we need to have 99.5 percent risk bar. But for the government,

which has social responsibilities, we expand that to 5 percent and 10

percent far, which will basically be 90 to 95 percent confidence. That will

become their capital requirement.

» Moderator | Richard K. Green

Okay, thanks. Let's move on to our discussants. First, we're going to

have In Seong Hwang from our host organization for this conference. Say

a few words?

» Moderator | Richard K. Green

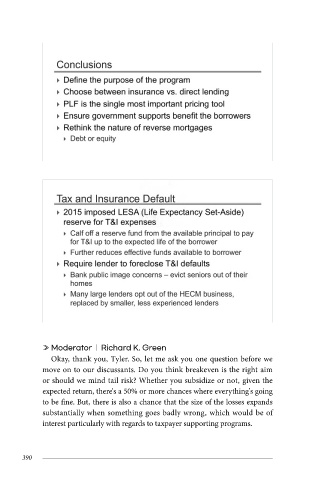

Okay, thank you, Tyler. So, let me ask you one question before we

move on to our discussants. Do you think breakeven is the right aim » Panelist | In Seong Hwang

or should we mind tail risk? Whether you subsidize or not, given the Head of Housing Finance Research Institute, Korea Housing Finance Corporation

expected return, there's a 50% or more chances where everything's going

to be fine. But, there is also a chance that the size of the losses expands Yes, it's a very nice and intuitive session, so I am very glad to

substantially when something goes badly wrong, which would be of participate in the discussion and talk about our product. Okay, I

interest particularly with regards to taxpayer supporting programs. prepared some slides, so let me start.

390 2019 6th AFIS & ASMMA Annual Meeting 391