Page 283 - 2019 6th AFIS & ASMMA

P. 283

Another important consideration is the potential funding cost Session I

advantage that you can derive by issuing a green bond by the covered

bond market, or by the senior unsecured market. In particular, in the

first years of green issuance, if you compare the green senior unsecured

bonds with non-green adjacent issues, you can see that the green senior

unsecured bonds actually trade notably tighter than their gray adjacent.

Now this pricing differential is far less straightforward in the covered

bond market, but things are really changing as the number of green

alternatives in the senior market expands, and the issue sizes expand in a

senior unsecured market. I would say, since the second half of 2018, this

funding cost advantage or this potential funding cost advantage in the

senior unsecured market has disappeared.

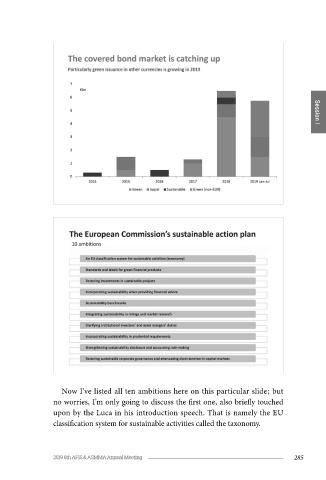

Now I think the covered bond market is really doing a good job in

terms of catching up of green issuance. In 2018, we have seen almost five

billion in green issuance, and this year, there has been quite a number

of green bonds supply. Not so much in the euro-denominated space

but more in other currencies. Now I would like to discuss some of the Now I've listed all ten ambitions here on this particular slide; but

regulatory impacts and how they could impact the green covered bond no worries, I'm only going to discuss the first one, also briefly touched

markets. And with regulatory impacts, I'm obviously referring to the upon by the Luca in his introduction speech. That is namely the EU

European Commission's very ambitious sustainable action plan. classification system for sustainable activities called the taxonomy.

284 2019 6th AFIS & ASMMA Annual Meeting 285