Page 367 - 2019 6th AFIS & ASMMA

P. 367

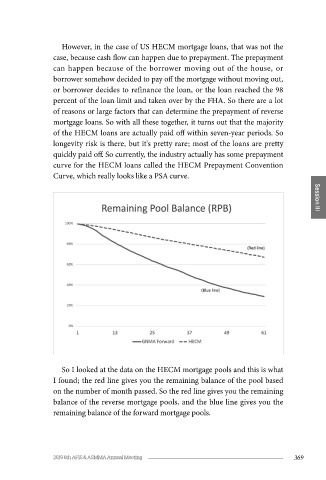

However, in the case of US HECM mortgage loans, that was not the

case, because cash flow can happen due to prepayment. The prepayment

can happen because of the borrower moving out of the house, or

borrower somehow decided to pay off the mortgage without moving out,

or borrower decides to refinance the loan, or the loan reached the 98

percent of the loan limit and taken over by the FHA. So there are a lot

of reasons or large factors that can determine the prepayment of reverse

mortgage loans. So with all these together, it turns out that the majority

of the HECM loans are actually paid off within seven-year periods. So

longevity risk is there, but it's pretty rare; most of the loans are pretty

quickly paid off. So currently, the industry actually has some prepayment

curve for the HECM loans called the HECM Prepayment Convention

Curve, which really looks like a PSA curve.

How the cash flow will look like? Well, the eventual cash flow is a Session III

main way of the payoff, so that's definite in a cash flow. It's very well

known that these is a considerable longevity risk involved, right? I'm

not sure if you have heard about the French lady who went into private

mortgage contract at the age of 80; she ended up living forty years more

and she passed away in age of 120. If this is the case when you're holding

the mortgage-backed security, you are not going to expect any cash flow

very soon; you are going to expect cash flow in 10, 20, or 30 years.

So I looked at the data on the HECM mortgage pools and this is what

I found; the red line gives you the remaining balance of the pool based

on the number of month passed. So the red line gives you the remaining

balance of the reverse mortgage pools, and the blue line gives you the

remaining balance of the forward mortgage pools.

368 2019 6th AFIS & ASMMA Annual Meeting 369