Page 368 - 2019 6th AFIS & ASMMA

P. 368

The last thing I wanted to take a look at is the actual trading activity

of the mortgage-backed securities. Those loans are traded in the capital

market, and take a look if the HMBS, the mortgage-backed securities

based on reverse mortgage are similar or different from the regular

forward mortgage-backed security loans. Based on about four years’

worth of trade database, it is estimated that the total number of trade

is about 15,000 for the HECM mortgage-backed securities, and about

540,000 for the regular Genie Mae forward MBS. So it's going to be

about thirty, thirty-five-times more. This is obvious because the prime

origination is much larger for the forward mortgage loans.

But other characteristics turn out to be pretty similar. If you're looking

at how the trade actually works, the fixed income trade happens between

the customer and the dealers or between the dealers, right? In the case

where are the HMBS, the customer trade is about 60 percent, and 40 Session III

percent is going to be inter-dealer trade. For the forward mortgage-

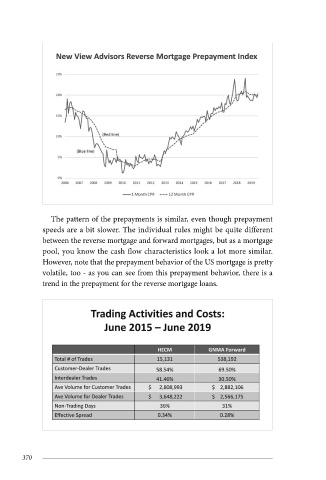

The pattern of the prepayments is similar, even though prepayment backed securities, about seventy percent is for the customer trade and

speeds are a bit slower. The individual rules might be quite different thirty percent for the inter-dealer trade. So we have more in inter-dealer

between the reverse mortgage and forward mortgages, but as a mortgage trades with HECM mortgage-backed securities because of the low

pool, you know the cash flow characteristics look a lot more similar. liquidity; the dealers will have more difficulty in managing the inventory,

However, note that the prepayment behavior of the US mortgage is pretty so it leads to more inter-dealer trading.

volatile, too - as you can see from this prepayment behavior, there is a

trend in the prepayment for the reverse mortgage loans. The size of each trade is pretty similar, especially for the customer

trades. So every size of the trade is about three million dollars for the

HECM MBS and the forward MBS. How frequently are they traded? If

you count the number of days where there's no trading, for the HECM

based trading we have about 36 percent of the days of the MBS not being

traded. For the forward mortgage-backed securities, it is pretty similar

with about 30 percent.

370 2019 6th AFIS & ASMMA Annual Meeting 371