Page 379 - 2019 6th AFIS & ASMMA

P. 379

Okay, in the private market, if it won't work, what they would do

is they will try to find a break-even pricing. The pricing in reverse

mortgages is defined by the principal limit factor, basically saying given a

million-dollar value of the current house, how much maximum amount

the bank is willing to give to the borrower as a loan amount? It could be

50 percent or 60 percent, or in some cases, it could be 20 percent. So they

just computed this by discounting the break-even point to the present

value to see how much it works.

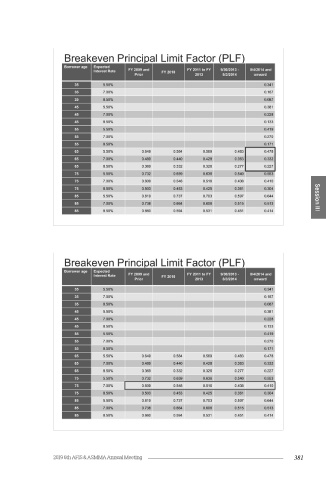

This is the principal limit factor worksheet. It's probably a little bit

small, but you have a copy in your slides. If we just compare the green

sheet, it's related to the age of the borrower. For the younger borrower,

the expected life would be much longer, so for that perspective the green

line will shift to the right and we will see the that the discount would be

deeper. So we see as the age increases, the amount of you can borrow Session III

would increase. If we just compare within the same age group, we see

that the lower the interest rate the environment is, the more fund the

bank is willing to lend, because the cost of capital or the rate of return

required by bank would be lower.

380 2019 6th AFIS & ASMMA Annual Meeting 381